- March 26, 2015

- Posted by: Wevio

- Category: Development, Wevio Blog

If you want to sell something online you need both a payment gateway and a merchant account. But, do you know the difference between a payment gateway and a merchant account? If you don’t, setting up an e-commerce website can get confusing and you could get hit with unexpected fees.

What is a Payment Gateway?:

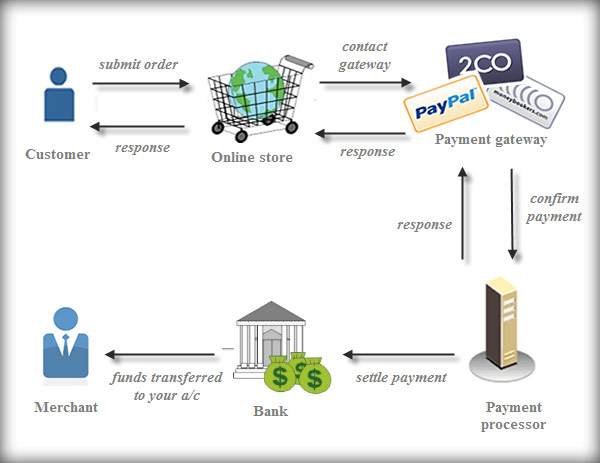

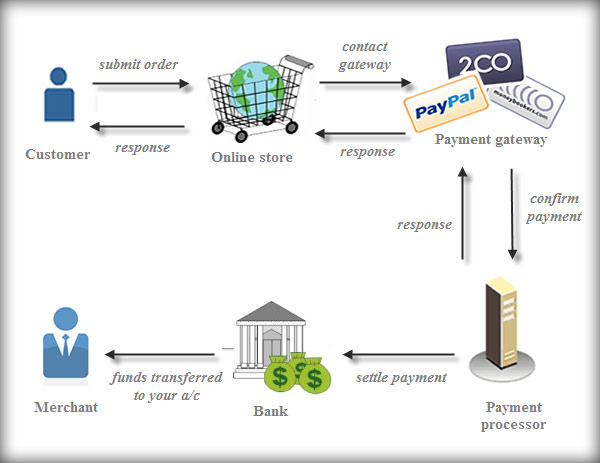

It is a service that automates the payment transaction between the shopper and merchant. It is usually a third-party service and is actually a system of computer processes that process, verify, and accept or decline credit card transactions on behalf of the merchant through secure Internet connections. When your customers are buying something from your online store they enter their credit card numbers during the checkout process. Your e-commerce site sends that credit card information to your payment gateway to authorize the transaction and process the payment. If the credit card information submitted to the payment gateway matches the information on file with the credit card company and the charge is approved the payment gateway will then transfer the money from your customer’s credit card into your “merchant account”.

What is a Merchant Account?

A Merchant Account involves a special type of arrangement with a bank or clearing house that allows you to accept credit card payments into a special bank account (your “Merchant Account”).

After a successful sale, money will me transferred into your merchant account and it will sit there for a few days, usually between 2 and 7 days and then in most cases it will automatically be transferred into your bank account. The bank account that you actually think of as your official account where you deposit checks and so forth. You can sort of think of your merchant account as a temporary holding tank for the money that comes in from online sales.

Dedicated Merchant accounts:

With a dedicated merchant account, transaction proceeds, less processing fees, are deposited directly into your business bank account. While the merchant account provider can correct errors, react to potential fraud, and debit your account for customer “chargeback” claims, this must all be done based on industry-standard credit card processing rules.

Aggregate Merchant accounts:

With an aggregated merchant account, transaction proceeds go to the service provider and are then deposited to your bank account at the provider’s discretion. There are no industry standards or rules that govern how an aggregated merchant account provider handles or disburses your money. The provider makes the rules, and can change them at will, so if you choose an aggregated merchant account pay very close attention to the contract terms and any changes made to them.

Types Of Merchant Accounts: Dedicated Vs Aggregate:

Getting a dedicated merchant account can take time. While there are some providers automating the process and providing same-day decisions, a typical application will take 48 hours to approve and additional time to integrate into a POS or electronic payment processing environment. Signing up for credit card processing under an aggregated account service provider can usually be done in minutes, and it often comes with an online system that can have you can actively process payments within the hour.

A dedicated merchant account is an account set up just for you, the merchant. This is like your very own online bank account set up just for your online business. If you set up an account with a payment gateway like Authorize.net or PayLeap you will also get a dedicated merchant account. With a dedicated merchant account you can often negotiate custom rates for your sales. The rates are based on the volume of sales you process and the types of products you sell.

An aggregate merchant account is one where your money gets dropped in a pool with a large number of other companies. Stripe and PayPal are examples of services that provide aggregate merchant accounts. You still need to provide some information about your company and the types of products you intend to sell but the process of getting connected with an aggregate merchant account is far less complicated and faster. The downside is that you have a little bit less control over how long it takes to get your money and you generally can’t negotiate the rates.

Getting your money:

With a dedicated merchant account most of the time you will receive your money in about 2 days. That means 2 days after the sale on your website, the money will be sitting in your normal business bank account. With an aggregate merchant account it usually takes longer. For example, Stripe an Aggregate Merchant Account holds your money for 7 days before transferring it into your bank account. PayPal will hold your money in your PayPal account indefinitely until you either spend the money by paying for something with the money in your PayPal account or you request the money to be transferred to your bank account. Once you have requested the money to be transferred, it takes about 5 business days to arrive in your bank account.

Conclusion:

Our suggestion is to use a payment gateway that offers an aggregate merchant account as part of their service like Stripe. You can be up and running, ready to accept live credit card payments in less than 10 minutes. No faxing of bank records or anything like that. You just sign up and go. If you’ve ever gone through the underwriting process for a dedicated merchant account you won’t believe how easy it is to get a Stripe account!